Needs Based Planning

This relationship is about you, and your needs. I use a needs-based approach to finding the right strategy for you. It all begins with listening. How do you define financial freedom? What are your goals? What do you want to be able to do?

Most importantly, what will help you sleep at night?

Most importantly, what will help you sleep at night?

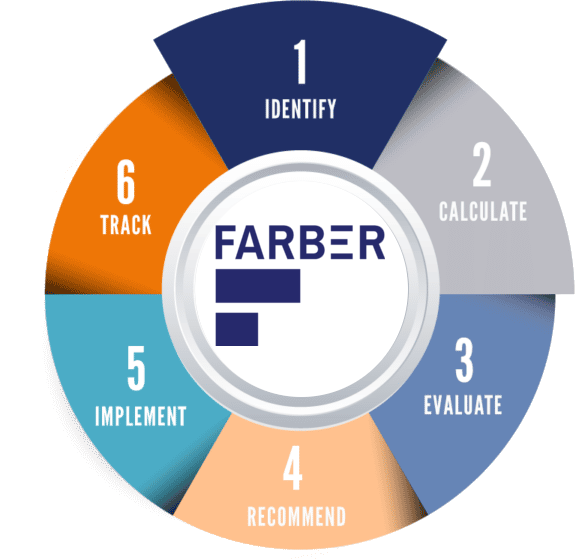

The Financial Planning Process

We follow a detailed and clearly defined process to allow for sustainable wealth management and creation—setting you on the right path to financial freedom. The following steps outline our process:

1 Identify

Firstly, we identify and prioritize your financial goals. Through this initial step, we obtain a clear understanding of your immediate needs, concerns, and aspirations.

2 Calculate

We compile and analyze relevant financial information and begin setting objectives. As we understand your unique requirements, we are able to calculate how much is needed to reach each individual goal and construct a personalized and comprehensive financial plan.

3 Evaluate

We will evaluate your current financial products and establish where you are with your goals and objectives. We consider factors such as personal financial management, risk management, retirement planning, tax and estate planning, and investment management. Additionally, we review your existing investment portfolio and risk tolerance to determine if you are on track and, if not, how to change the trajectory to get your goals in alignment.

4 Recommend

Our team will recommend the best strategies and tax-efficient solutions that will support your financial goals. Advice such as the best low-cost ETF and portfolio managers or the most suitable life, disability, and critical illness solutions will take you forward with confidence and certainty around your financial future.

5 Implement

We work with you to implement and manage the recommended solutions and strategies. We establish time frames for each recommendation, to ensure that your goals are achieved. Collectively these steps will help kick- start your financial journey with ease.

6 Track

We track your goals on an ongoing basis. A successful plan is dependent on continuous tracking and review, be it annually or as your circumstances change, to ensure that the plan remains meaningful and relevant to you and your loved ones. Your life changes often—and financial plans and goals should change with it.