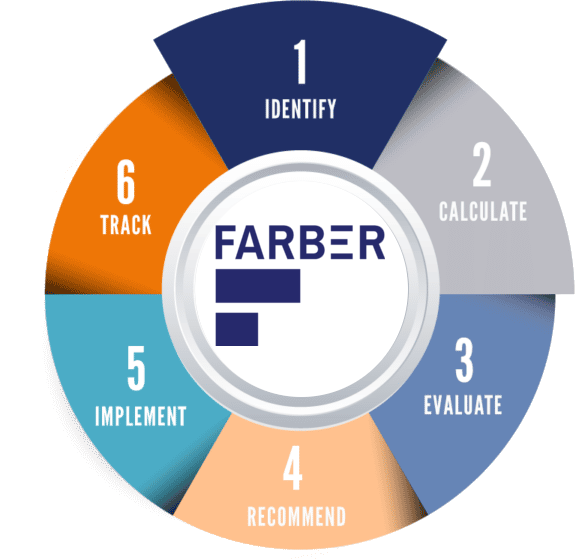

Corporate Financial Planning

Your goals as a business owner should support your vision. This is where Farber Wealth can help. The end result? A holistic financial plan for your business, where we focus on achieving your unique goals. This may sound complex—but it doesn’t have to be.

Succession Planning

Group Benefits

Are you looking to hire and retain top staff? Are you looking for a cost-efficient way to give your employees more work satisfaction?

According to Glassdoor website, 4 out of 5 employees prefer group benefits over a pay raise.

We have benefit options available for companies from 1 to 10,000 employees. Call me for more information, and how this could really save you money!